Italian E-Invoice

Context

If your business is based in Italy, you should check if you’re expected to comply with the “Fatturazione Elettronica” (E-Invoicing) directive. More info here.

If you must issue “electronic invoices” (that is, submit the invoice to the taxation authority instead of sending them directly to your customers), alf.io helps you to collect all the required information for doing that.

Limitations

Alf.io is not capable of sending the invoices directly to the italian taxation authority, so you’ll have to submit them manually.Configuration

How to activate Italian E-Invoice

Please follow the tutorial on how to activate invoices, then enable the following option:

How does it work

Reservation Process

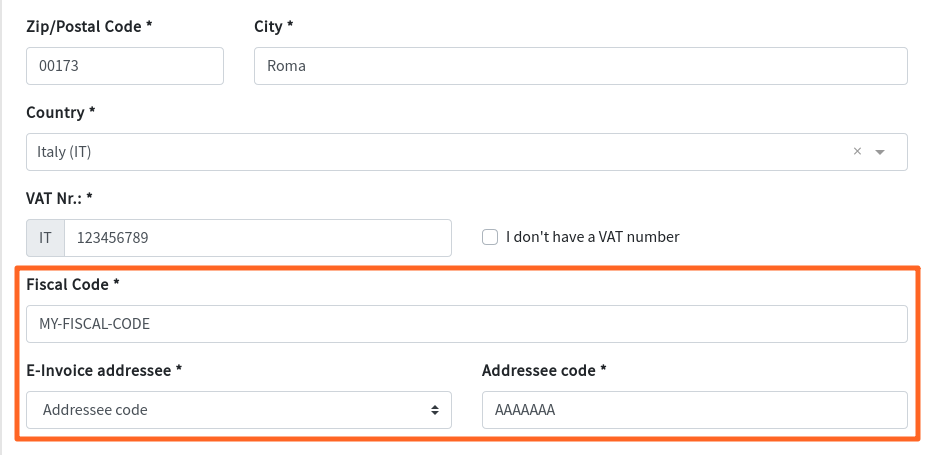

It is mandatory to register all the transactions, even if the customer is not a company. Alf.io will request billing data for each customer buying a ticket, and if they set Italy (IT) as their billing country, they’ll be asked to fill additional fields

Fiscal Code (Codice Fiscale)

It’s the Tax Code for private customers and companies. It is a required information

E-Invoice addressee (Destinatario Fattura Elettronica)

It specifies the final recipient of the invoice. It can be:

- Addressee Code (Codice Destinatario): an alphanumeric code assigned to companies or to invoicing systems.

- PEC: an certified e-mail address, see more

- Neither: if the buyer does not have none of the above

Reservation Confirmed

Once the Reservation has been confirmed/paid by the customer, the organizer will receive a notification email with the following contents:

- The customer’s billing details, as specified during the reservation process

- The Invoice in PDF format. This contains all the information that must be sent to the taxation authority